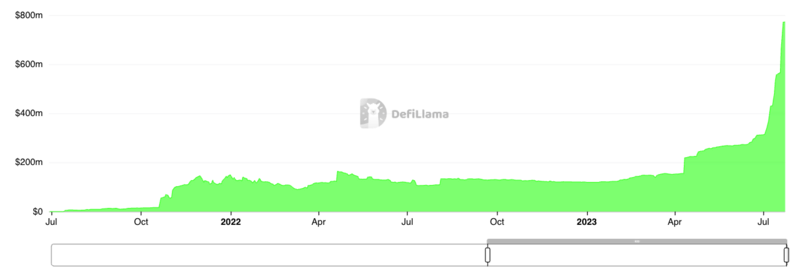

Tokenizing Real-World Assets (RWAs) has been quite the hype for the past few months. We find numerous web3 companies embarking on a transformative journey, one that involves tokenizing tangible assets like art, music, collectibles, and properties. These assets are no longer confined to the physical realm; their ownership is now firmly established on the blockchain, reshaping the very foundations of the financial world. Among the companies at the forefront of this transformative shift are Polytrade Finance, Centrifuge, Maple Finance, and Goldfinch. These innovators are actively exploring avenues to provide significant value to their users through the utilization of Real-World Assets. In this article, we will unbox the potential of Real-World Asset tokenization and how Polytrade Finance is stepping up to lead the charge in making RWAs the cornerstone of the decentralized future. Before we move any further, let’s halt and take a look at what is meant by Real-World Asset (RWA) Tokenization. Take an example of art. Famous paintings like “The Last Supper” by Leonardo Da Vinci or “Scream” by Edvard Munch are said to be worth $450 million and $119.9 million respectively, and can be too expensive to be owned by a single person. What would an art fanatic like you and me would do then? This is where Real-World Asset Tokenization comes in. RWA Toeknization essentially tokenizes these physical assets by representing them as digital tokens on blockchain networks. Tokenization involves converting the ownership or value of a Real-World Asset into a digital representation, which can then be traded, divided into fractions and managed on blockchain platforms. This process enhances the liquidity, accessibility, and divisibility of real-world assets, making them easier to buy, sell, and trade in the digital world. So the next time you want to buy the Mona Lisa without spending $860 million, just own a fraction of the painting for a few bucks through tokenization! This graph portrays the remarkable trajectory of RWAs since April 2023, where a notable surge in Total Value Locked (TVL) within the RWA ecosystem is observed. By the end of July 2023, the TVL had surpassed an impressive milestone, breaching the $770 million mark. This substantial TVL signifies not only the present strength of RWAs but also shows a glimpse into their promising future as more and more protocols dive into the RWA ecosystem. To further break it down, here are the top 10 protocols based on their TVLs, that are working in the RWA domain in web3. The burgeoning popularity of RWAs in Web3 is driven by a multitude of factors. One pivotal catalyst is the growing recognition of the advantages that tokenizing these assets brings. Tokenization, the process of converting Real-World Assets into digital tokens on blockchain networks, presents a multitude of benefits: Polytrade Finance has emerged as a pioneering force at the forefront of Real-World Asset (RWA) tokenization. The platform is setting new standards by providing a blockchain-based ecosystem that bridges the gap between digital assets and the tangible world. With a focus on innovation, security, and inclusivity, Polytrade Finance is on a mission to redefine the way both businesses and investors interact with tangible assets in the digital age. Polytrade Finance envisions a world where RWAs take the spotlight in the Web3 arena, empowering individuals with unprecedented access to valuable assets. Empowering Real-World Assets Polytrade Finance recognizes the enormous potential of RWAs to reshape the financial landscape. By bringing RWAs to the forefront of Web3, the platform aims to democratize wealth and investment opportunities, making valuable assets accessible to a wider audience. Progress Towards the Vision Polytrade Finance is not just about a vision; it's about action. The project has taken several significant steps to turn this vision into reality: Polytrade Finance's flagship product, Polytrade Marketplace, serves as the gateway to a world of financial possibilities. This user-friendly platform offers a wide array of features designed to empower users, both seasoned investors and newcomers, including: Polytrade Marketplace is more than just a trading platform; it's a financial frontier where RWAs meet revolutionary trading. As the future of asset trading unfolds, it does so with Polytrade Marketplace leading the way. Their dedication to innovating the RWA space, their experienced team, strong partnerships, and versatile $TRADE token all combine to make a significant impact on the DeFi landscape. In conclusion, the rise of Real-World Assets (RWAs) and their tokenization marks a monumental shift in the world of decentralized finance (DeFi). Projects like Polytrade Finance are spearheading this transformative journey, bridging the divide between physical assets and the digital realm. As we witness the ascending trend of RWAs, characterized by significant Total Value Locked (TVL) and the active participation of top protocols, the potential for democratized wealth and enhanced accessibility becomes abundantly clear. Polytrade Finance's innovative approach, experienced team, secure infrastructure, and the empowering Polytrade Marketplace converge to redefine the financial landscape. With RWAs and NFTs poised for synergy, the future of DeFi shines brighter than ever, and Polytrade Finance stands at its forefront, beckoning us into a decentralized era of limitless possibilities. Also read Riding the NFT Wave: The BAYC Phenomenon and the State of NFTs in 2023What are Real-World Assets (RWAs)?

The Ascending Trend of RWAs in Web3

What Makes RWAs Stand Out?

Case Study: Polytrade Finance

The Vision of Polytrade Finance

Polytrade Marketplace: Offering a Gateway to RWAs

Conclusion

References:

Signup for The Vulcan Voice newsletter now and stay ahead of the curve!

Signup for The Vulcan Voice newsletter now and stay ahead of the curve!